Some News items. But mainly personal opinions that may be unreasonable, without warrant, meaningless and shameless but relentless and consistent as a blinking light. Of course there is that story about Antoine-Laurent de Lavoisier, the guy who discovered and named oxygen & hydrogen and executed during the reign of terror. He purportedly asked a servant to see if his eyes blinked after he was beheaded. No one could prove the story. But maybe we can see after death.

Sunday, July 31, 2011

Friday, July 29, 2011

GDP drops

Tuesday, July 26, 2011

Some don't care about the collapse of the debt ceiling negotiations

Why Some People Are Just Fine with the Collapse of the Debt Ceiling Negotiations

If political functionality were a means test for a country’s credit-worthiness, the US would have lost its AAA rating a long time ago. The country which prides itself as the “World’s Greatest Democracy” has puts its dysfunctional political system on display for months now, in a struggle to get the debt ceiling increased. The resulting spectacle has nauseated even the ever-complacent American public: both Democrats and Republicans are now given losing grades by the voters for their performance in this farce. If the country had a legitimate third party to vote for, the Democrats and Republicans would be in serious trouble. Of course, the political system is geared to prevent third parties from emerging, so the country flounders about, looking for leadership from pusillanimous Democrats or ideological Republicans who consider raising taxes a mortal sin. The voters are probably a few steps away from concluding what is meant to be hidden but by now should be obvious: American democracy doesn’t exist, and the political system in Washington is beyond repair. What is worse: there are people and organizations who like things just the way they are and will fight any attempts at reform.

Sunday, July 24, 2011

On the Norwegian killer

Calculating political terror

http://translate.google.com/translate?hl=no&sl=no&tl=en&u=http://www.tv2.no/nyheter/innenriks/gjerningsmannen-la-ut-video-og-manifest-paa-nettet-3545104.html

Tuesday, July 19, 2011

Designing Your Death Dossier - WSJ.com

By SAABIRA CHAUDHURI

It isn't enough simply to sign a bunch of papers establishing an estate plan and other end-of-life instructions. You also have to make your heirs aware of them and leave the documents where they can find them.

Consider: At least 10 states have been investigating whether some of the country's largest insurers are failing to pay out unclaimed life policies to beneficiaries. California and Florida have held public hearings on the issue in recent weeks.

Insurers say they are behaving lawfully. Under policy contracts, they aren't required to take steps to determine if a policyholder is still alive, but instead pay a claim when beneficiaries come forward.

You can avoid such problems by securing important documents and telling your family where they are stored.

Jean Parr is grateful that her mother obsessed about the subject. "I really didn't want to think about it," says Ms. Parr, 54 years old, a manager at the American Chemical Society in Washington. But when her mom died in 2005, she knew exactly where to look for the will, the key to a safe-deposit box and documents indicating her mother had paid and arranged for her own funeral.

The financial consequences of failing to keep your documents in order can be significant. According to the National Association of Unclaimed Property Administrators, state treasurers currently hold $32.9 billion in unclaimed bank accounts and other assets. (You can search for unclaimed assets at MissingMoney.com .)

Most experts recommend creating a comprehensive folder of documents that family members can access in case of an emergency, so they aren't left scrambling to find and organize a hodgepodge of disparate bank accounts, insurance policies and brokerage accounts.

You can store the documents with your attorney, lock them away in a safe-deposit box or keep them at home in a fireproof safe that someone else knows the combination to.

That isn't to say you should keep everything. Sometimes people hold onto so many papers that loved ones can't find the important ones easily.

In 2008, Jane Bissler, a counselor in Kent, Ohio, approached her then-87-year-old mother about organizing her documents. Because her mom was a widow with relatively simple finances and two homes, Ms. Bissler, 57, says she figured it would be a relatively simple task.

Instead, it took an entire year for Ms. Bissler and her mother to go through all of her papers, which included documents from eight bank accounts, utility bills from the 1950s and reams of canceled checks.

The two of them pared down the stash from four four-drawer filing cabinets to one two-drawer cabinet, shredding anything extraneous. Ms. Bissler and her mother visited banks and brokerages to ensure she was listed on all of her mother's accounts. Her mother died in May 2009.

"It would have been a total nightmare if we hadn't gone through it all with her," Ms. Bissler says. "It was that Depression-era stuff where you keep everything and hide other things." Ms. Bissler estimates that having the documents organized ahead of time spared them from ordering an additional 15 copies of the death certificate and "years" of time.

Here is a rundown of the most important documents you'll need to have signed, sealed and delivered. You should start collecting these as soon as possible and update them every few years to reflect changes in assets and preferences. Some—such as copies of tax returns or recent child-support payments—need to be updated more often than others.

The Essentials

An original will is the most important document to keep on file.

A will allows you to dictate who inherits your assets and, if your children are underage, their guardians. Dying without a will means losing control of how your assets are distributed. Instead, state law will determine what happens.

Wills are subject to probate—legal proceedings that take inventory, make appraisals of property, settle outstanding debt and distribute remaining assets. Not having an original document means this already-onerous process could be much more of an ordeal, since family members can challenge a copy of a will in court.

Rick Law, founder of estate-planning firm Law ElderLaw LLP in Aurora, Ill., says estate planners increasingly recommend revocable trusts in addition to wills, since they are more private and harder to dispute. "Every will is like a compass that points toward the closest courthouse," he says.

A revocable living trust can be changed anytime during your lifetime. After you transfer ownership of various assets to the trust, you can serve as the trustee on behalf of beneficiaries you designate. Provided you do so, there aren't any ongoing fees.

If your family can't find the original trust documents, you are "basically setting your estate up for litigation," says Duncan Moseley, vice president of Sanders Financial Management in Atlanta.

A "letter of instruction" can be a useful supplement to a will, though it doesn't hold legal weight. It is a good way to make sure your executor has the names and contact information of your attorneys, accountants and financial advisers. While the will should be stored with your attorney or in a courthouse, the letter of instruction should be more readily accessible, particularly if it contains instructions on funeral arrangements.

Also, make sure your heirs have access to a durable financial power-of-attorney form. Without it, no one can make financial decisions on your behalf in the event that you are incapacitated.

Proof of Ownership

You should keep documentation of housing and land ownership, cemetery plots, vehicles, stock certificates and savings bonds; any partnership or corporate operating agreements; and a list of brokerage and escrow mortgage accounts.

If you don't tell your family that you own such assets, there is a chance they never will find out. Mr. Moseley says in such an event, clients must perform their own detective work, watching the mail for real-estate tax bills or combing bank accounts for interest payments, for example.

File any documents that list loans you have made to others, since they could be included as assets in an estate. Similarly, keep a list of any debts you owe to avoid surprising your family. Wills and living trusts generally are drafted to include provisions for how debts should be settled, and creditors have a stipulated period of time in which to file a claim against the estate.

Make the most recent three years of tax returns available, too. "Looking at last year's returns offers a snapshot of what assets we should be looking for this year," says Lesley Moss Mamdouhi, a principal at estate-law firm Oram & Moss in Chevy Chase, Md. This also will help your personal representative file a final income-tax and estate return and, if necessary, a revocable-trust return.

Bank Accounts

Mr. Law recommends sharing a list of all accounts and online log-in information with your family so they can notify the bank of your death. "If nobody ever takes any more out or puts money in, it becomes a dormant account and then becomes the property of the state," he says.

Be sure to list any safe-deposit boxes you own, register your spouse or child's name with the bank and ask them to sign the registration document so they can have access without securing a court order.

Health-Care Confidential

Possibly the most important health-care document to fill out in advance is a durable health-care power-of-attorney form. This allows your designee to make health-care decisions on your behalf if you are incapacitated. The document should be compliant with federal health-information privacy laws, so that doctors, hospitals and insurance companies can speak with your designee. You may also need to fill out an Authorization to Release Protected Healthcare Information form.

If you are incapacitated and your family can't locate a health-care power of attorney, they will have to go to court to get a guardian appointed.

Porter Storey, executive vice president of the American Academy of Hospice and Palliative Medicine in Glenview, Ill., says it isn't enough to establish a health-care power of attorney unless you have explained to your designee how you would like to be treated in case of incapacity. He also recommends writing a living will detailing your wishes.

After Diane Dimond's mother had a series of strokes in 2006, Ms. Dimond knew there was a signed living will tucked away in a safe at home. Ms. Dimond, 58 and living in New York, recalls the Sunday she watched her mother in a coma and was able to fulfill her wishes never to be kept on external life support. "It was gut-wrenching," she says, "but I took the physician aside and said, 'I want to take her home.'" Having her mother's living will enabled Ms. Dimond to do just that.

The living will and the power of attorney constitute what are called "advance directives"; some states consolidate these into a single form. (AARP offers a state-by-state listing of advance-directive forms on its website.) Terminally ill patients may wish to have their doctors sign a do-not-resuscitate order.

Certain companies, such as Advance Choice Inc.'s DocuBank, will keep copies of health-care documents for a fee. Subscribers get a wallet-sized card and, in case of an emergency, a hospital will call DocuBank, which will fax over the information.

Life Insurance and Retirement Accounts

Copies of life-insurance policies are among the most important documents for your family to have. Family members need to know the name of the carrier, the policy number and the agent associated with the policy.

Be especially careful with life-insurance policies granted by an employer upon your retirement, since those are the kind that financial planners most often miss, says David Peterson, CEO of Denver-based Peak Capital Investment Services. New York state alone is holding more than $400 million in life-insurance-related payments that have gone unclaimed since 2000, according to the state comptroller's office.

Estate planners also recommend that you draw up a list of pensions, annuities, individual retirement accounts and 401(k)s for your spouse and children.

An IRA is considered dormant or unclaimed if no withdrawal has been made by age 70½. According to the National Association of Unclaimed Property Administrators, tens of millions of dollars languish in unclaimed IRAs every year.

If your heirs don't know about these accounts, they won't be able to lay claim to them, and the money could languish. The U.S. Department of Labor estimates that each year tens of thousands of workers fail to claim or roll over $850 million in 401(k) assets. You can track unclaimed pensions, 401(k)s and IRAs at Unclaimed.com.

Marriage and Divorce

Ensure your spouse knows where you have stored your marriage license. Mary Cay Corr, now 74 and living in Raleigh-Durham, N.C., couldn't locate hers when her husband died. "I had to write to New York, where we got married, and pay for a new marriage license to prove that I had been married to my husband before I could claim anything," she says.

For divorced people, it is important to leave behind the divorce judgment and decree or, if the case was settled without going to court, the stipulation agreement, says Linda Lea Viken, president of the American Academy of Matrimonial Lawyers in Chicago. These documents lay out child support, alimony and property settlements, and also may list the division of investment and retirement accounts.

Include the distribution sheet listing bank-account numbers that accompanied the settlement to avoid disputes about ownership or payments due. Also include a copy of the most recent child-support payment order. In the majority of states, the obligation to pay child support still exists after death.

Ms. Viken also recommends filing copies of any life-insurance papers. In many states if you have a policy that benefits your children, it can be set off against the ongoing child support.

You also should include a copy of the "qualified domestic-relations order," which can prove your spouse received a share of your retirement accounts.

—Mary Pilon contributed to this article.Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Feminization or domestication

Friday, July 8, 2011

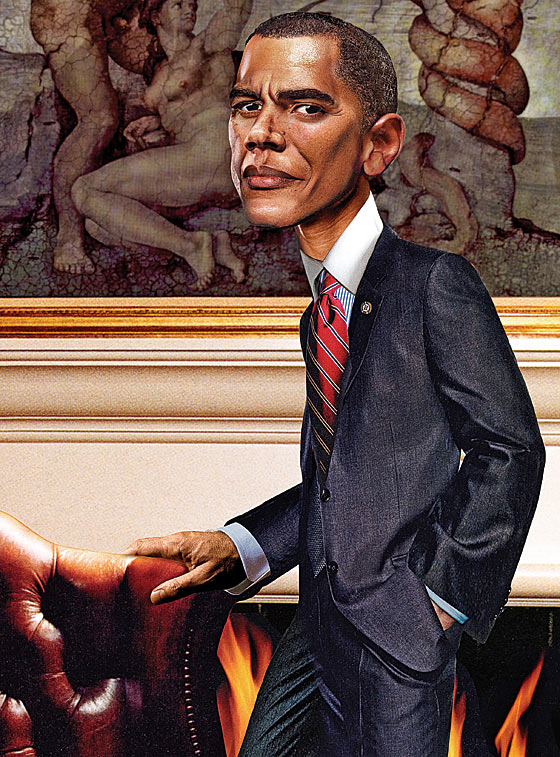

Obama's Original Sin--Frank Rich

Obama’s Original Sin

The president’s failure to demand a reckoning from the moneyed interests who brought the economy down has cursed his first term, and could prevent a second.

- By Frank Rich

- Published Jul 3, 2011

|

Illustration by Eddie Guy |

A case in point was the late-May celebration of the centennial rededication of the New York Public Library. Surely no civic institution could be a more unimpeachable beard for a blowout. The dress code—no black tie—was egalitarian. The Abyssinian Baptist Church Gospel Choir, the New York City Gay Men’s Chorus, and that cute chorus from P.S. 22 in Staten Island—Glee diversity on steroids—were in the house along with some 900 invited guests, marquee names included (Toni Morrison, Jonathan Franzen). Bloomberg delivered a pre-dinner benediction from an altarlike perch on the main reading room’s balcony. “Free and open access to information may be the single most important component of any democratic society,” he said.

But it was impossible to banish toxic trace memories of the financial meltdown. Some two weeks earlier, the mayor had restricted the “free and open access” he now extolled. His fiscal 2012 budget called for slashing $40 million from the library system, a cut that would have mandated four-day weeks and the shutdown of a dozen branches.

There was also the awkward matter of the gala’s “corporate chair,” Brian Moynihan, the CEO of Bank of America. In the pageantry preceding Bloomberg’s remarks, the slightly flushed Moynihan, looking like a nervous ring bearer in a stately wedding ceremony, was among those singled out by the announcer while marching down the reading room’s long center aisle in a processional of library trustees. No doubt he earned this honor by ponying up to give more New Yorkers more books. But free and open access to the unexpurgated books of his own bank—and of its gutted acquisitions, Merrill Lynch and Countrywide Financial—would be a far more valuable gift to our democratic society. Just a week before the library fête, the Huffington Post reported that B of A was stonewalling the Department of Housing and Urban Development’s investigation into fresh charges of defrauding taxpayers. Down in Naples, Florida, one Bank of America victim, Warren Nyerges, a 45-year-old retired cop, was getting ready to take the law into his own hands. Through a bureaucratic blunder—or worse—the bank had hounded his family for over a month, trying to foreclose on his house even though it was entirely debt-free. Unable to recover the legal expenses inflicted by this harassment, Nyerges staged a ruckus by hiring a lawyer who “foreclosed” on the bank’s local branch instead.

Nyerges, at least, would pry loose a settlement of $5,772 in early June. We could use him in New York, perhaps packing heat. Justice has not come to the city or its publicly funded institutions, which wouldn’t be in the fiscal hole they’re in today had malefactors like Bank of America not wrecked the economy in the first place and required taxpayer bailouts (two in B of A’s case). Still, you can’t blame the NYPL for collecting whatever reparations it could from Moynihan. One of the library’s formative patrons, present at the original dedication exactly 100 years earlier, was Andrew Carnegie, a ruthless tycoon second to none. But Carnegie did build a steel empire that sped the growth of the nation. Our own Gilded Age’s legacy is the financial “products” that greased the skids of America’s decline. At the centennial gala, you couldn’t escape the paw print of Stephen Schwarzman, the Blackstone Group billionaire whose library gift had entitled him to blast his name on any stray expanse of marble on the 42nd Street building. Schwarzman is nothing if not a representative 21st-century titan. His principal monument has been to himself, namely a notorious over-the-top 60th-birthday party, exquisite in both its bad timing and bad taste, that he threw the year before the crash. (If you’re shelling out a million bucks for an entertainer, is Rod Stewart the best you can do?) He is perhaps most renowned of late for comparing Obama to Hitler because the administration dared propose taxing private-equity firms’ share of client profits at a rate higher than 15 percent. (He later apologized.)

On that Monday night, the Republican Schwarzman was a political outlier in the crowd, which was dominated by New York’s liberal elite, financial and cultural divisions. Even Moynihan has been a faithful Democratic donor. These were Obama’s people (myself, yes, among them), and the worldly, let’s-turn-the-page spirit in the library that night uncannily reminded me of the hubristic vibe of Obama’s White House: The worst of the downturn is past, the wobbly economy will eventually creep forward, let the healed too-big-to-fail banks move on, and pray that the lagging indicators (i.e., employment) will catch up. Indeed, it’s a certain swath of the New York liberal elite that helped reinforce that Obama mind-set to begin with. Uncorrected, it could lead the president to defeat in 2012, even against a roster of opponents that almost everyone there that night would cavalierly dismiss as clowns.

After the 1929 crash, and thanks in part to the legendary Ferdinand Pecora’s fierce thirties Senate hearings, America gained a Securities and Exchange Commission, the Public Utility Holding Company Act, and the Glass-Steagall Act to forestall a rerun. After the savings-and-loan debacle of the eighties, some 800 miscreants went to jail. But those who ran the central financial institutions of our fiasco escaped culpability (as did most of the institutions). As the indefatigable Matt Taibbi has tabulated, law enforcement on Obama’s watch rounded up 393,000 illegal immigrants last year and zero bankers. The Justice Department’s ballyhooed Operation Broken Trust has broken still more trust by chasing mainly low-echelon, one-off Madoff wannabes. You almost have to feel sorry for the era’s designated Goldman scapegoat, 32-year-old flunky “Fabulous Fab” Fabrice Tourre, who may yet take the fall for everyone else. It’s as if the Watergate investigation were halted after the cops nabbed the nudniks who did the break-in.

Even now, on the heels of Bank of America’s reluctant $8.5 billion settlement with investors who held its mortgage-backed securities, the Obama administration may be handing it and its peers new get-out-of-jail-free cards. With the Department of Justice’s blessing, the Iowa attorney general, Tom Miller, is pushing the 49 other states to sign on to a national financial settlement ending their investigations of the biggest mortgage lenders. What some call a settlement others may find a cover-up. Time reported in April that the lawyer negotiating with Miller for Moynihan’s Bank of America just happened to be a contributor to his 2010 Iowa reelection campaign. If the deal is struck, any truly aggressive state attorneys general, like Eric Schneiderman of New York, will be shut down before they can dig into the full and still mostly uninvestigated daisy chain of get-rich-quick rackets practiced by banks as they repackaged junk mortgages into junk securities.

Those in executive suites at the top of that chain have long since fled the scene with the proceeds, while bleeding shareholders, investors, homeowners, and cashiered employees were left with the bills. The weak Dodd-Frank financial-reform law that rose from the ruins remains largely inoperative, since the actual rule-writing was delegated to understaffed agencies now under siege by banking lobbyists and their well-greased congressional overlords. The administration’s much-hyped Consumer Financial Protection Bureau is being sabotaged by Washington Republicans intent on blocking any White House nominee, whether Elizabeth Warren or some malleable hack, to lead it. “We can’t let special interests win this fight,” said Obama when he proposed the agency in October 2009. Well, he missed his moment to fight for both it and Warren, and the special interests won without breaking a sweat.

Rather than purge the crash’s crimes, Wall Street’s leaders are sticking to their alibi: Everyone was guilty of fomenting this “perfect storm,” and so no one is. Too-big-to-fail banks are bigger than ever, and Masters of the Universe swagger is back. Even Jamie Dimon of JPMorgan Chase, about the only bank chief not to be caught with a suspect balance sheet or a $1,400 office trash can, has taken to channeling Schwarzman. In June, he publicly challenged Ben Bernanke about the intolerable burdens of potential regulation—this despite a 67 percent surge in JPMorgan’s first-quarter profits and a 1,500 percent raise in his own compensation from 2009 to 2010. As good times roar back for corporate America, it’s bad enough that CEOs are collectively sitting on some $1.9 trillion in cash—much of it parked out of the IRS’s reach overseas—instead of hiring. (How many jobs can you buy for $1.9 trillion? America’s total expenditure on the Iraq and Afghanistan wars over a decade has been $1.3 trillion.) But what’s most galling is how many of these executives are sore winners, crying all the way to Palm Beach while raking in record profits and paying some of the lowest tax rates over the past 50 years.

The fallout has left Obama in the worst imaginable political bind. No good deed he’s done for Wall Street has gone unpunished. He is vilified as an anti-capitalist zealot not just by Republican foes but even by some former backers. What has he done to deserve it? All anyone can point to is his December 2009 60 Minutes swipe at “fat-cat bankers on Wall Street”—an inept and anomalous Ed Schultz seizure that he retracted just weeks later by praising Dimon and Lloyd Blankfein as “very savvy businessmen.”

He stocked his administration with brilliant personnel linked to the bubble: liberals, and especially Ivy League liberals. Nearly three years on, they have taken a toll both on the White House’s image and its policies. Obama arrives at his reelection campaign not merely with a weak performance on Wall Street crime enforcement and reform but also with a scattershot record (at best) of focusing on the main concern of Main Street: joblessness. One is a consequence of the other. His failure to push back against the financial sector, sparing it any responsibility for the economy it tanked, empowered it to roll over his agenda with its own. He has come across as favoring the financial elite over the stranded middle class even if, in his heart of hearts, he does not.

The economic narrative of his presidency has been bookended by well-heeled appointees with tax issues. First came his Treasury secretary, Timothy Geithner, introduced to the public as a repeat tax delinquent, just too important to attend to the fine print that troubles mere mortals. This January, when Obama at long last created a jobs council, he appointed Jeffrey Immelt, CEO of G.E., to lead it. The Times did the due diligence the White House didn’t and found that G.E. paid essentially no U.S. taxes on $14.2 billion of profit, even as it has shed one fifth of its American workforce since 2002. Were Immelt creating more new American jobs in his new administration role than he has at G.E., perhaps we could understand why Obama kept him on. But his only visible achievement has been to co-write a “progress report” on his efforts for The Wall Street Journal op-ed page in June. It read like a patronizing corporate annual report aimed at small shareholders—a boilerplate wish list of bullet points followed by a promise that “a more strategic view” would be unveiled by September, a full nine months after he took his assignment. Maybe he and the president can hash it out this summer on the Vineyard.

A recent poll put Obama in a dead heat with Mitt Romney. Mitt Romney! The savior of the working stiff!The roots of Obama’s capture by the corporate axis of influence inexorably trace back to his own personal Zelig, the former Clinton Treasury secretary and Harvard Corporation stalwart Robert Rubin. In The Audacity of Hope, published in late 2006, Obama called Rubin, then busily cheerleading the excessive risk at Citigroup, “one of the more thoughtful and unassuming people I know.” Two years later, when Citi cratered and threatened to take the economy with it, Rubin demonstrated his unassuming thoughtfulness by denying that he had anything to do with the toxic investments that cost taxpayers a $45 billion bailout and 52,000 Citi employees their jobs.

In his unseemly revolving-door career, Rubin not once but twice sped the Citi apocalypse—first in government, where he and his eventual successor as Treasury secretary, Larry Summers, championed the deregulatory policies that facilitated the consolidation of too-big-to-fail banks, and then in his $15 million-a-year role as Citi’s “guru,” where, by his own later account, he had no idea what was in the worthless paper the bank peddled to greedy dupes. You’d think Obama would have dumped him faster than he did the Reverend Wright, but that’s misreading him. Obama is preternaturally secure on thorny matters of race—as his magnificent speech on the subject made clear—and could distance himself from his preacher with no ambivalence. It’s “unassuming” braininess that’s his blind spot.

And so a parade of Rubin acolytes entered the White House, led by Geithner, a nearly lifelong civil servant so identified with the financial Establishment that even Mayor Bloomberg mistakenly introduced him as a Goldman alumnus at a public event in New York last year. It’s Geithner’s influence on policy, however, not his persona, that proved fateful. Not until March 2010 did the White House get its first explicit, modest jobs bill through Congress.

By failing to address that populist anger, Obama gave his enemies the opening to co-opt it and turn it against him. Which the tea party did, dishonestly but brilliantly, misrepresenting Obama’s health-care-reform crusade as yet another attempt by the elites to screw the taxpayer. (The Democrats haplessly reinforced the charge with marathon behind-the-scenes negotiations with insurance and pharmaceutical-industry operatives.) Once the health-care law was signed, the president still slighted the unemployment crisis. A once-hoped-for WPA-style public-works program, unloved by Geithner, had been downsized in the original stimulus, and now a tardy, halfhearted stab at a $50 billion transportation-infrastructure jobs bill produced a dandy Obama speech but nothing else.

Obama soon retreated into the tea-party mantra of fiscal austerity. Short-term spending cuts when spending is needed to create jobs make no sense economically. But they also make no sense politically. The deficit has never been a top voter priority, no matter how loudly the right claims it is. At Obama’s inaugural, Gallup found that 11 percent of voters ranked unemployment as their top priority while only 2 percent did the deficit. Unemployment has remained a stable public priority over the deficit ever since, usually by at least a 2-to-1 ratio. In a CBS poll immediately after the Democrats’ “shellacking” of last November—a debacle supposedly precipitated by the tea party’s debt jihad—the question “What should Congress concentrate on in January?” yielded 56 percent for “economy/jobs” and 4 percent for “deficit reduction.”

Geithner has pushed deficit reduction as a priority since before the inauguration, the Washington Post recently reported in an article greeted as a smoking gun by liberal bloggers. But Obama is the chief executive. It’s his fault, no one else’s, that he seems diffident about the unemployed. Each time there’s a jolt in the jobless numbers, he and his surrogates compound that profile by farcically reshuffling the same clichés, from “stuck in a ditch” to “headwinds” (first used by Geithner in March 2009—retire it already!) to “bumps in the road.” It’s true the administration has caught few breaks and the headwinds have been strong, but voters have long since tuned out this monotonous apologia. The White House’s repeated argument that the stimulus saved as many as 3 million jobs, accurate though it may be, is another nonstarter when 14 million Americans are looking for work.

In early June, the unemployment rate—7.8 percent when Obama took office and as high as 10.1 percent during his tenure—ticked upward to 9.1 percent. That cued a ubiquitous press refrain that no president since FDR has been reelected with an unemployment rate higher than 7.2 percent (as it stood when Reagan overcame a recession to win in 1984). Later that month, a plurality in a Bloomberg survey said the economy was worse now than when Obama took office.

The ultimate indignity, though, was a Washington Post / ABC News poll showing Obama in a dead heat with Mitt Romney. Mitt Romney! If any belief unites our polarized nation, it’s the conviction that Romney is the most transparent phony in either party, no matter how much he’s now deaccessioning hair products. It’s also been a Beltway truism that a Mormon can’t win the Republican nomination, let alone a Massachusetts governor who devised the prototype for “ObamaCare.” But that political calculus changed overnight. That this poseur could so quickly gain traction, even if evanescently, should alarm Obama.

It was on Monday, June 13, that the new state of play crystallized. That morning, Immelt unveiled his vacuous op-ed and rendezvoused with Obama in Durham, North Carolina, for a double-feature dog-and-pony show: a meeting of the otherwise invisible White House jobs council (only its second to date) and yet another small-bore presidential photo op promoting yet another green-tech employer illustrating the latest dim-wattage administration slogan, “Winning the Future.” Unfortunately for the White House, the Times front page delivered another message above the fold that morning: OBAMA SEEKS TO WIN BACK WALL ST. CASH. Among the objects of Obama’s affection interviewed was an unnamed Democratic financier who found it ironic that “the same president who once criticized bankers as ‘fat cats’ would now invite them to dine at Daniel, where the six-course tasting menu runs to $195 a person.”

No one doubts that Romney is a shape-shifter par excellence, whether on abortion, health care, cap and trade, or the Detroit bailout (which he predicted would speed GM and Chrysler to their doom). In his last presidential run, he was caught fabricating both his prowess as a hunter and a nonexistent civil-rights march starring his father and Martin Luther King. But to masquerade as a latter-day FDR is a new high in chutzpah even by his standards. The only examples he can cite as a job creator are his “turnaround” of the Salt Lake City Olympics in 2002 and his ability to grow Bain Capital, the private-equity firm he founded, from “ten employees to hundreds.”

By failing to address populist anger, Obama gave his enemies the opening to co-opt it and turn it against him. Which the tea party did, dishonestly but brilliantly.The most significant workers he added to the payroll in Salt Lake City were sixteen lobbyists, at a cost of nearly $4 million, to solicit taxpayers’ subsidies—“more federal cash than any previous U.S. Olympics,” according to The Wall Street Journal. That’s hard to square with Romney’s current stand that jobs will bloom across the land if government stops giving any handouts (even to tornado victims, he said in the GOP debate) and lets the free market work its magic. As for his fifteen years in the corporate-buyout business, he was best known for the jobs Bain shredded at the once-profitable companies it took over and then demolished for parts.

It’s a record Romney perennially tries to cover up. It may have cost him his Senate race against Ted Kennedy in 1994. In that campaign, Romney was stalked by a “Truth Squad” of striking workers from a Marion, Indiana, paper plant who had lost jobs, wages, health care, and pensions after Ampad, a Bain subsidiary, took control. Ampad eventually went bankrupt, but Bain walked away with $100 million for its $5 million investment. It was an all-too-typical Romney story, which is why Mike Huckabee could nail him with his memorable 2008 wisecrack: “I want to be a president who reminds you of the guy you work with, not the guy who laid you off.” Stephen Colbert recently topped Huckabee, portraying Romney as a cross between Gordon Gekko and Jack Kevorkian because of the profitable mercy killings of companies in Bain’s care. When Romney was governor, his record was no better. A Northeastern University analysis of his term (2003–6) found that Massachusetts was one of only two states to have no growth in their labor forces. The other was Louisiana, which happened to have an excuse named Katrina.

That Romney thinks he can pass himself off as the working stiff’s savior and Obama as the second coming of the out-of-touch patrician George H.W. Bush of 1992 truly turns reality on its head. Obama’s palling around with Rubinistas may be too much for his administration’s or the American people’s good, but Romney is a bona fide plutocrat whose financial backers include David Koch and whose idea of a joke was to tell a group of out-of-work Floridians on the campaign trail, “I’m also unemployed.” Yet so far, Romney is getting away with it, and the Republican Establishment, smelling a savior, is happy to embrace and embroider his proletarian masquerade. Peggy Noonan recently anointed this well-connected son of a Detroit CEO and Michigan governor a “self-made” financial success. Should the ersatz Horatio Alger end up on a ticket with a right-wing pseudo-populist—Michele Bachmann, unlike Romney, is quite at ease with bashing Wall Street—it’s not inconceivable he could ride a sputtering recovery further than anyone expects.

There’s not much Obama can do to alter the economy by 2012, given the debt-ceiling fight, the long campaign, and nihilistic Capitol Hill antagonists opposed to any government spending that might create jobs and, by extension, help Obama keep his own. But the central question before the nation couldn’t be clearer: Who pays? The taxpayers bailed out the elite; now it’s the elite’s turn to return the favor. Massive cuts to the safety net combined with scant sacrifice from those at the top is wrong ethically and politically. It is, in the truest sense, un-American. Obama knows this, and he hit a welcome note last week when he urged some higher corporate taxes for hedge funds and the like. But his forays in this direction are tentative and sporadic. You have to wonder why he isn’t seizing the moment to articulate and fight for the big picture instead of playing a lose-lose game of rope-a-dope with the Republicans on their budgetary turf.

“A nation cannot prosper long when it favors only the prosperous,” Obama declared at his inauguration. What he said on that bright January morning is no less true or stirring now. For all his failings since, he is the only one who can make this case. There’s nothing but his own passivity to stop him from doing so—and from shaking up the administration team that, well beyond the halfway-out-the-door Geithner and his Treasury Department, has showered too many favors on the prosperous. This will mean turning on his own cadre of the liberal elite. But it’s essential if he is to call the bluff of a fake man-of-the-people like Romney. To differentiate himself from the discredited Establishment, he will have to mount the fight he has ducked for the past three years.

The alternative is a failure of historic proportions. Those who gamed the economy to near devastation—so much so that the nation turned to an untried young leader in desperation and in hope—would once again inherit the Earth. Unless and until there’s a purging of the crimes that brought our president to his unlikely Inauguration Day, much more in America than the second term of his administration will be at stake.

As culled from the president's public appearances.

As culled from the president's public appearances.

As to debt, deficit negotiatio